Why Modern Food & Beverage Brands Need Demand Planning

For modern CPG food & beverage companies selling both DTC and B2B, demand planning isn’t a nice-to-have to “get to later”, it’s a process that helps decide:

- How much cash is tied up in inventory

- Whether retailer OTIF targets are hit or chargebacks pile up

- How much product gets written off when shelf life sneaks up

- Whether teams spend the week running the business or reconciling CSVs

The reality of a modern food & beverage brand

In today’s environment, modern CPG brands in food & bev:

- Sell on Shopify, Amazon, and wholesale/retail at the same time

- Work with co-packers and ingredient suppliers well in advance to accommodate long lead times and larger MOQs

- Produce items that are shelf-stable but not immortal — expiry and freshness still matter

- Serve retailers that expect high service levels, clean fill rates, and flawless promo execution

- Are constantly launching new SKUs, flavors, bundle configurations, and variety packs

All of these moving parts are connected by a single backbone: the demand plan. When that plan is wrong, everything downstream feels it in the form of:

- Excess stock and cash trapped in slow-moving inventory

- Stockouts during launches, promos, and seasonal peaks

- Expired or short-dated product that must be discounted or written off

Modern food & beverage operations need demand-driven planning, not “produce and pray.”

Why demand planning is difficult

Even for longer-shelf-life products like snacks, beverages, sauces, frozen items, or pantry goods, planning is more complex than in many other CPG categories.

1. Shelf life is a hard constraint, not just a printed date

Planning in food & bev is never just “how much to buy or make.” It is “how much can be sold before it expires” — by channel, customer, and location.

Effective planning must:

- Track expiration dates and lots across the network

- Enforce FIFO/FEFO rules across warehouses and 3PLs

- Anticipate write-offs and discounting instead of discovering them later

- Tie shelf life directly into purchasing, production, and allocation decisions

When systems treat expiry as an afterthought, margin erosion is inevitable.

2. Promotions and seasonality drive huge swings

Trade promotions, retailer features, influencer pushes, and DTC campaigns can rapidly spike demand.

A realistic planning process needs to:

- Model trade promos and events explicitly in the forecast

- Incorporate seasonal patterns (summer spikes, holidays, BFCM, new-year health cycles, etc.)

- Separate short-term lift from long-term baseline demand

- Align inventory, capacity, and co-packer schedules to those spikes

When promo and seasonal behavior isn’t embedded in the plan, brands either miss sales or overbuy and carry excess stock.

3. Omnichannel demand with different rules per channel

The same SKUs often serve very different demand patterns and service expectations across:

- DTC websites, where stockouts damage brand trust and repeat rates

- Marketplaces like Amazon, where availability impacts ranking

- Retail and distributor partners, where poor service can trigger chargebacks, delistings, or delayed expansion

Competent demand planning in food & bev requires channel-level forecasts and policies, not a single blended number. Retailers, distributors, and DTC channels each need distinct service levels, safety stock rules, and planning horizons.

4. Constrained and messy supply chains

Food & beverage supply chains are full of constraints:

- Co-packers with fixed production windows and minimum runs

- Ingredients with lengthy lead times or tedious measurement conversions

- Supplier MOQs, pallet rules, and batch sizes

- Multi-node networks with 3PLs, internal distribution centers, and specialized transportation vehicles

A simple “forecast minus on-hand equals order” approach doesn’t work in this environment. The planning system has to understand these real-world constraints and convert demand into practical, constraint-aware purchasing and production plans.

5. Manual planning doesn’t scale

Spreadsheets work when brands have:

- A small number of SKUs

- One primary channel

- A straightforward warehouse setup

Beyond that point, spreadsheets become brittle:

- Files grow large and fragmented (when you restart them each month)

- Logic is buried in complex formulas known only to a few people

- New SKUs, channels, or warehouses require major template surgery

At scale, this is no longer a planning system — it is a collection of manual artifacts that struggle to keep pace with the business.

What “good” demand planning looks

Any robust demand planning solution should deliver five core capabilities.

1. A single source of truth for demand, inventory, and supply

All critical signals need to live in one place:

- Sales from Shopify, Amazon, wholesale portals, EDI, and retailer data feeds

- Inventory positions across 3PLs, internal DCs, and co-packers

- Open purchase orders, production runs, and transfer orders

Without this consolidated view, planning cycles become reconciliation exercises instead of decision-making processes.

2. Forecasts that match how the business really sells

Forecasting for food & beverage must account for:

- Seasonality and recurring patterns

- Trade promotions, campaigns, and events

- Product life cycles, new launches, and cannibalization of existing SKUs

- Channel- and customer-specific demand behavior

Modern planning blends top-down targets with bottom-up, data-driven forecasts, making it possible to view demand by product, group, channel, and key account while keeping everything tied together in a single coherent plan.

3. Shelf-life-aware inventory optimization

“In stock” is not enough; the focus has to be on sellable stock.

An effective system:

- Monitors expiration dates and lot-level inventory

- Flags expiry and short-dated risk early enough to act

- Forecasts ingredient and packaging consumption alongside finished goods

- Helps determine where inventory should sit to maximize sell-through before expiry

This turns shelf life from an operational surprise into a proactive planning dimension.

4. A clear link from demand → supply → production

A forecast is only valuable if it flows through to concrete actions.

In a strong setup, demand drives:

- Raw material and packaging requirements (true MRP)

- Production and co-packer schedules that respect capacity and minimums

- Purchase orders for both finished goods and components that align with supplier constraints

Every change in the plan should automatically translate into updated material needs and order recommendations, not another manual Excel landing zone.

5. Exception-based, scenario-driven management

Planning teams are most valuable when they are evaluating scenarios and resolving exceptions, not manually re-keying data.

A mature demand planning environment provides:

- Alerts and exception lists for stockout risk, overstock, expiry, and capacity issues

- Scenario planning tools for promotions, new accounts, co-packer delays, or ingredient shortages

- Automation that handles repetitive tasks while keeping operators in control

This shifts day-to-day work from firefighting to deliberate tradeoff decisions.

Where spreadsheets and legacy ERPs fall short

In practice, most brands end up with one of two primary tools: spreadsheets or a legacy ERP.

Spreadsheets

- Struggle with growing SKU counts, channels, and warehouses

- Make it difficult to enforce consistent shelf-life logic, MOQs, and pack rules

- Turn every planning cycle into a manual copy/paste exercise

- Concentrate institutional knowledge in a few “Excel owners,” creating risk

Legacy ERPs and generic systems

- Are built to record transactions, not to optimize inventory or forecast demand

- Impose rigid structures that don’t reflect real-world channel, promo, and product hierarchies

- Rarely provide proactive alerts, recommendations, or scenario tools

- Often require heavy customization to approximate a workable planning process

The result is a gap between how operations actually function and what the system is capable of representing. Tether exists to close that gap.

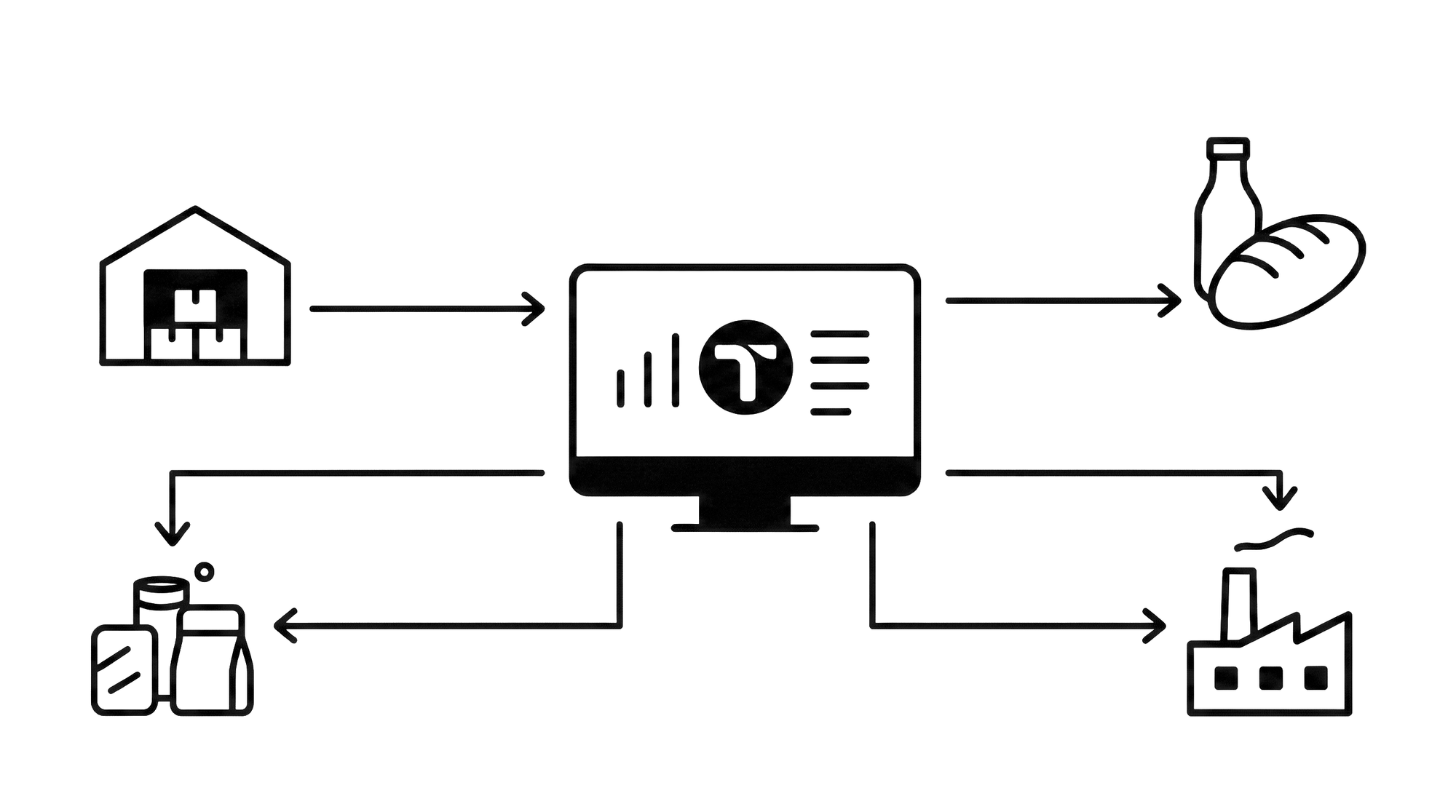

How Tether supports modern food & beverage brands

Tether is a demand planning and inventory platform built for all fast-growing consumer brands, especially in food & beverage.

1. Omni-channel demand in a single view

Tether unifies sales and inventory across DTC, Amazon, TikTok, Walmart, wholesale, retail, and more into a single, real-time environment. Data is organized using the same language brand operators use every day: flavors, pack sizes, variety packs, channels, and locations.

Teams can:

- Analyze performance by any dimension they care about: flavor, format, bundle, channel, or account

- View inventory across raw and finished goods, co-packers, suppliers, and 3PLs

- Align demand, inventory, and supply decisions from one system instead of stitching reports together

2. Forecasting and planning designed for food & bev

Tether’s planning engine is tailored to the way food & bev brands grow:

- Built-in support for seasonality and life-cycle curves

- Structured trade promotion planning by channel and account

- Forecasting of ingredient and packaging consumption off finished goods demand

- Combined top-down and bottom-up planning workflows

Instead of forcing operators into generic models, Tether reflects the realities of food & beverage sales patterns.

3. Shelf life, lots, and waste as first-class concepts

Tether treats shelf life as core planning data, not a side note.

The platform includes:

- Expiration and batch/lot tracking linked directly to inventory and orders

- Reporting by ingredient, packaging, and finished goods to expose where waste occurs

- Waste and loss tracking that connects operational issues to financial impact

- Visibility into raw vs finished inventory by supplier, 3PL, and warehouse

This allows brands to plan inventory in a way that actively minimizes expiry and write-offs.

4. Demand-linked MRP and supply automation

Tether connects demand planning straight into supply and production workflows:

- Automatically generated PO and production recommendations based on demand, safety stock, and lead times

- Material requirements planning that translates finished goods demand into ingredient and packaging needs

- Support for multi-supplier strategies, MOQs, pallet and case-pack constraints, and lead-time variability

- Smart alerts for inventory, supply, and capacity so teams can work from an exception list

What many organizations previously stitched together with multiple tools and spreadsheets is consolidated into one cohesive planning environment.

5. Flexible architecture and AI for real-world edge cases

Most CPG operations are full of edge cases: retailer-specific rules, unique bundles, supplier shutdowns, regional mixes, innovation pipelines.

Tether is built to accommodate that complexity:

- Integrates with existing systems such as ERP, WMS, 3PL portals, and marketplaces

- Supports custom channel structures, product hierarchies, and planning rules without a massive IT project

- Uses AI to automate routine tasks — such as PO suggestions, reorder checks, and data entry — with clear guardrails so operators remain in control

The result is a planning system that provides leverage without sacrificing nuance.

For food & beverage brands looking to build a durable, scalable planning backbone, Tether is designed to serve as the operating system for demand, inventory, and supply decisions.